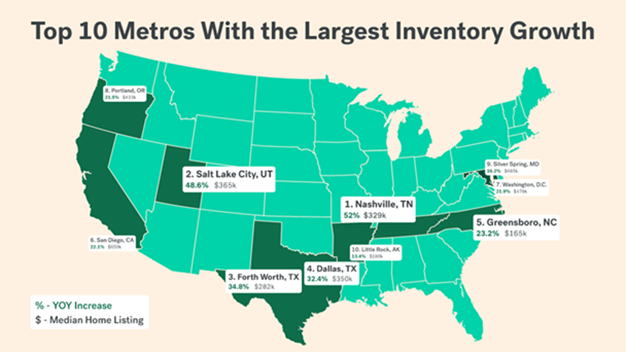

Dallas’ constricted housing market took a small dose of real estate Miralax in the second quarter, but analysts say that relief is likely not long-lasting. The Dallas metro saw a year-over-year increase of more than 32 percent in housing inventory — homes, new and old, available for sale — during the April-June period, according to a report from home listing site Trulia. This means that the Dallas metro’s stock grew to include 14,875 houses, up from 11,653 in the first quarter — and up from 11,234 houses for sale in second quarter of 2017. The Fort Worth metro was similar, with nearly 35 percent inventory growth in that time period. This inventory spike, while far from providing complete relief for the metro’s housing market, is the highest in recent months.

The cities with the most significant additions to inventory — Nashville (52 percent), Salt Lake City (48.6 percent) and Dallas-Fort Worth — are all in states with robust construction markets and ample land to build, said Laila Assanie, senior economist with the federal Reserve Bank in Dallas. There are some other indicators of temporary blockage relief: The Dallas area had a brisk second quarter for new home starts and a slow(ish) June for home sales. Observers recorded more than 9,900 home starts in DFW in the second quarter, according to local real estate analyst Residential Strategies, 12 percent more than that period last year. Meanwhile, DFW real estate agents sold 10,754 pre-owned homes in June. It’s a healthy number, but represents 3 percent fewer such sales than in June of 2017.

In May 2018, there were only 1.8 months of inventory for homes for sale in the $200,000 to $299,999 price range, slightly more than in months previous. While the loosening of inventory will give more choice to consumers and perhaps take some of the urgency out of home buying, it’s still not satisfying the ample demand, Assanie said. Most inventory gains are coming in price points above $500,000, she said. But the demand isn’t built up for homes above $500,000, where there’s more than seven months of inventory.

Overall, Assanie is optimistic that developers will respond to demand and the market will hit a sweet spot without overbuilding or overpricing. Plus, if interest rates continue to climb, absorption rates may slow somewhat. “I’m not too worried about Dallas,” he said. “Any supply issues have to be watched, but it’s more of a timing issue than anything.”

– Dallas Morning News, July 12, 2018